2. Regulation of American stock exchanges

Legislative regulation of

stock trading in the United States plays an important role in ensuring the efficient functioning of organized commodity and financial markets. At the beginning of the history of stock trading in the United States, regulation contributed to the geographical coordination of organized agricultural markets located in different states.

In the late 1800s, laws and

rules regulating stock trading were aimed at regulating the agricultural market, the main goal of which was to create an efficient price mechanism.

Speculation could contribute to the efficiency of the American

stock market and required transparent regulation. In the early 1900s, the US government took a relatively negative position regarding the influence of speculation on stock trading due to its likely impact on prices and

volatility.

US futures markets required special regulation. Thus, in 1922, Congress adopted the first regulation of grain trading, adopting the Grain Futures Act. This law was passed after the collapse of grain prices after World War I, when the World Trade Organization accused

speculators of adversely affecting price dynamics. The farm lobby pressured Congress to completely ban futures trading, accusing speculators of aggressive behavior on exchange platforms.

The Grain Futures Act of 1922 introduced a provision requiring futures trading to be conducted only on regulated platforms - on commodity exchanges in the United States. This law introduced a strict system of trader reporting, according to which each participant was obliged to report daily on the market positions of each trader and, in case of excess, to report. It should be noted that these requirements have remained with the Commodity Futures Trading Commission - the state regulator of commodity exchange markets.

Between 1922 and 1936, there was no change in federal regulation of grain exchanges. In 1933, the Glass-Steagall Act separated commercial and investment banking, and the subsequent regulation of stock market trading in 1929 led to the Great Depression. This act was intended to restrict the use of bank loans for speculative trading in the U.S. commodity and stock markets. In essence, commercial banks were restricted from trading in

securities in order to prevent excessive use of customer funds for risky speculative strategies in the securities markets.

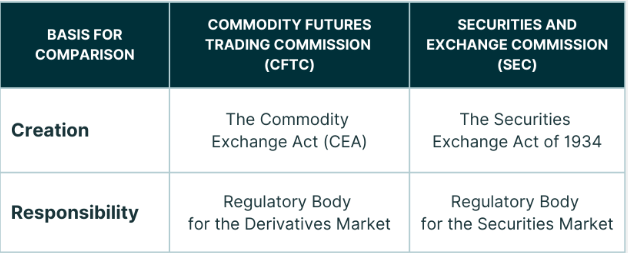

In 1936, the Commodity Exchange Act was passed, which amended the Grain Futures Act. This law deepened the regulation of the activities of American commodity exchanges and additionally established strict restrictions on futures trading exclusively on exchanges, which strictly prohibited

over-the-counter trading of futures on commodity assets, in particular wheat, corn, silver, etc. At the same time, the law also expanded its powers to other types of commodity assets, namely cotton, rice, compound feed, butter, eggs, potatoes. In this regard, the keyword “grain” in the title of the law was changed to “commodities”.

In accordance with this law, Congress created a federal agency for the management of commodity exchanges, located within the US Department of Agriculture, to monitor the activities of commodity exchanges and prevent market manipulation.

The Commodity Exchange Act gave the Commodity Exchange Commission the authority to regulate commodity exchanges by establishing federal restrictions on speculative strategies, as well as on unscrupulous

hedgers who could not comply with exchange trading requirements, as well as elevators who did not comply with storage regulations. Another important measure in strengthening regulation was the segregation in customer accounts of funds allocated for margin deposits to guarantee exchange transactions.

It should also be noted that this law prohibited trading in options on various assets due to speculative fraud. This strict regulatory approach allowed to avoid speculative manipulations, but created certain problems for the economy by restraining the liquidity of exchange trading.

The emergence of a state regulator, the Commodity Exchange Commission, contributed to transparency on exchange platforms. The commission was composed mainly of representatives of state institutions, ministries and the justice system. The main t

asks of the state body were:

- licensing of exchange trading in commodity assets;

- registration of traders and

brokers on exchanges;

- restriction of speculative transactions;

- prohibition of price manipulation;

- prohibition of the dissemination of false information;

- bringing to justice for violations of norms.

For more than a decade, the Commission provided information for participants on exchange and over-the-counter platforms. The Commission's authority included agricultural products and futures contracts on them.

Over time, the US Congress ensured the creation of the Commodity Futures Trading Commission (CFTC), which replaced the previous Commission. The Commodity Futures Trading Commission Act of 1974 expanded its jurisdiction.

The Commodity Futures Trading Commission still has broad authority over exchange participants. Under the new law, only the Commission can regulate futures trading and license exchanges to introduce new futures contracts. The Commission developed requirements for futures exchanges that could not violate them.

An important mission of the Commission was to regulate the activities of exchange warehouses, and also gave it the privilege to impose disciplinary sanctions on all violators of exchange trading. Under certain circumstances, the Commission could take extraordinary measures, for example, in cases of manipulation and distortion of competition in organized commodity markets.

The Commission has significant powers to monitor the activities of brokers, traders, operators, and other participants in commodity markets. It establishes the conditions for responding to allegations of violations of federal laws by participants in exchange markets.

The Commission has required exchanges and clearing houses to report regularly and has assigned representatives from the Commission to each commodity exchange to monitor compliance with the law.

The Commission has the authority to suspend or revoke licenses if violations are detected at commodity exchanges and brokerage houses.

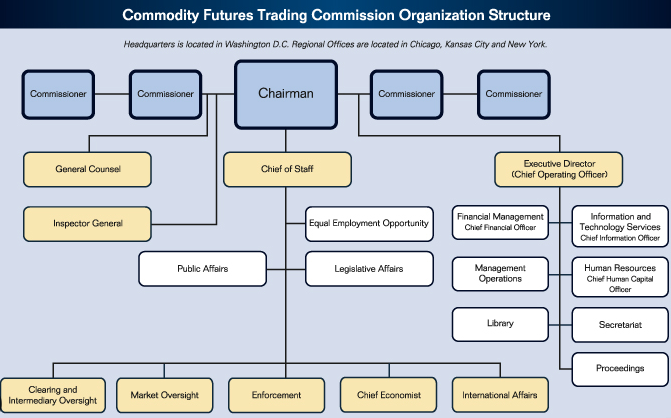

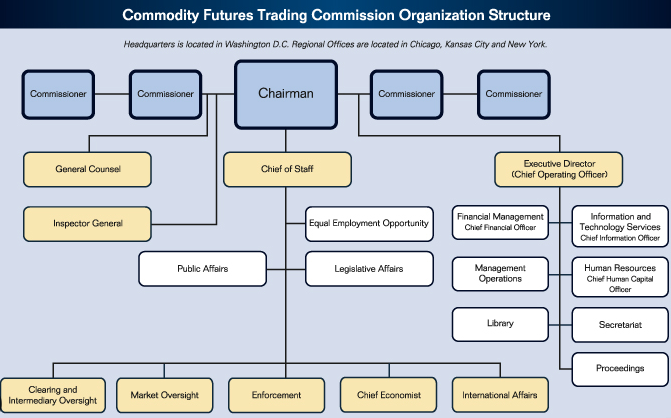

The Commodity Futures Trading Commission consists of a chairman and commissioners, as well as 14 operating departments. It is headed by a chairman and an executive director.

The Commission is a federal body appointed by Congress. The chairman of the commission belongs to the same party as the US president. He is elected for a 5-year term and is confirmed by the Senate.

The National Futures Association plays an important role in protecting the interests of participants in the US stock market. The NFA was founded on September 22, 1981, when the Commodity Futures Trading Commission officially granted the NFA the status of a “registered futures association.” The NFA began its regulatory activities in 1982.

Regulators create transparent conditions for all participants in the exchange trading of commodity or financial derivatives.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу