Topic. 2: Analytical assessment of international stock exchanges

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 2: Analytical assessment of international stock exchanges |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:42 |

1. Географічне зонування міжнародної біржової діяльності

2. Assessment of the international stock trading state

3. Prospects for international stock exchange activity in the context of globalization

-

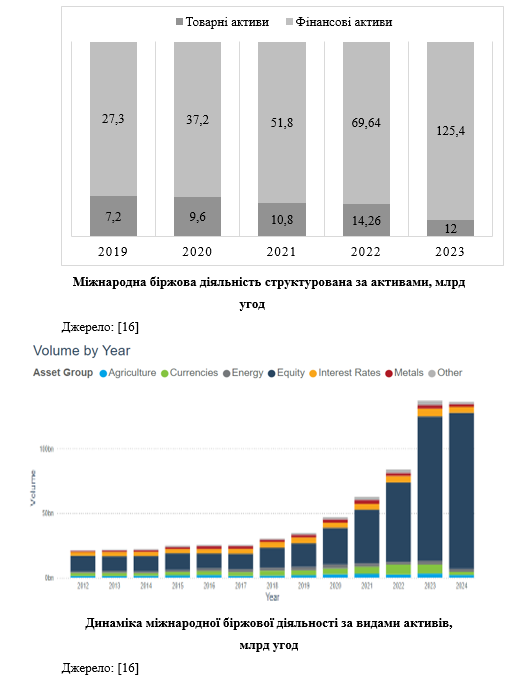

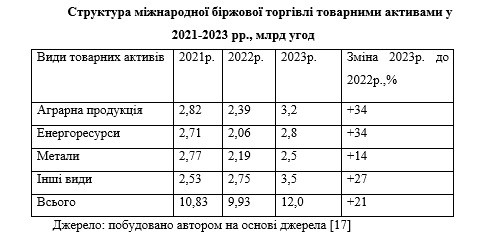

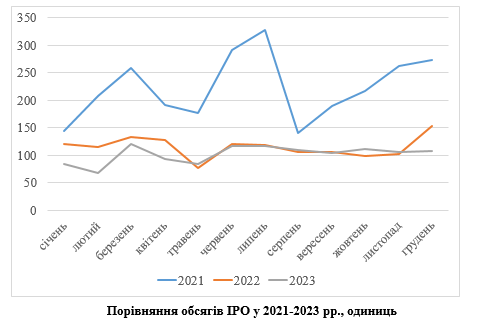

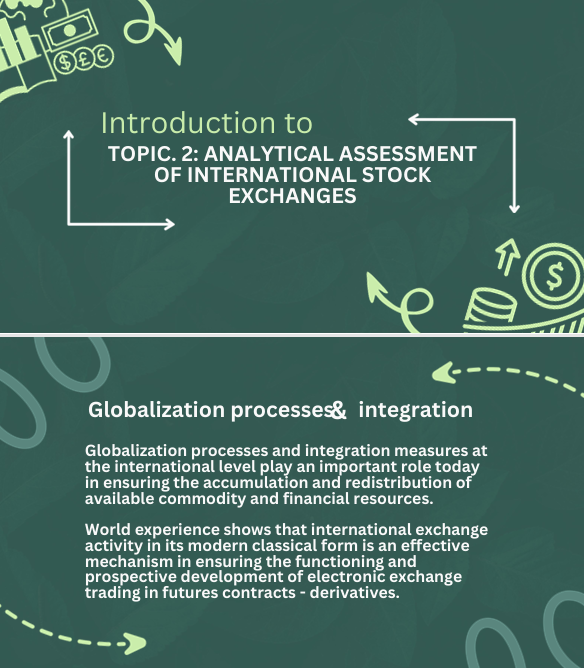

The current state and prospects for the development of international stock exchange activity are now closely intertwined with global processes in various spheres of public life.The reports of the World Federation of Stock Exchanges for 2023 (appendices) indicate that international stock exchange activity has undergone significant transformations against the background of key geopolitical events, namely the Israel-Gaza war and the continuation of the war in Ukraine. Despite this, capitalization on international stock exchanges increased by 13.6% in 2023 compared to the previous year.At the same time, the value of trading on stock exchanges, the number of new listings and international investment flows decreased.In contrast, international stock exchange trading in derivative contracts has increased significantly, in particular, the largest increases were noted in the group of stock options.This situation indicates an increase in uncertainties in international commodity and financial markets, which required a significant search for price risk management tools.The main trends in the development of international exchange activity in the capital market include:- Growth in global capitalization on world-class stock exchanges by 13 trillion USD in 2023.- Trading volumes of exchange-traded contracts on stock exchanges in 2023 increased in quantitative equivalent, but decreased in value.- The average trading volume was at its lowest level in the last three years - at 2776.45 USD/per transaction.- Non-IPO listings in the Americas and Europe-Middle East-Africa (EMEA) stock exchange regions were minimal in the last three years, while the Asian region (APAC) recorded maximums.- The number of IPOs in 2023 across all regions was the lowest in recent years at 1,217.Capital raised through IPOs declined sharply in international markets in 2023 (59.3%). However, in the ARAC and AMEA regions, the reduction was recorded at -43.3% and -86.1%, while in the American region there was an increase of -71.3%.

The Futures Industry Association cites in its reports the following promising areas for the development of international exchange activity:- growth in the volume of exchange trading in derivative contracts and commodity and financial assets;- increased demand for exchange instruments in the context of the continuation of the war in Ukraine and the Israel-Gaza war;- creation of favorable conditions for financial provision with credit resources;- expansion of the range of services for exchange traders;- growth in the share of financial derivatives trading in the overall structure of international exchange trading;- achieving a new record in the volume of international exchange trading;- implementation of artificial intelligence in exchange procedures;- tokenization of exchange instruments and the spread of new innovative solutions.The problems that still face exchange participants, as in previous periods, include:- overcoming wars and military conflicts and establishing integration relationships of an organizational and regulatory nature;- strengthening the fight against the main factors of instability at the global and national levels;- liberalization and unification of the regulatory framework at the global level;- improving the ways of accumulation and transfer of free capital.The analytical report of the Futures Trading Association indicates that in 2023 the main problems faced by exchange trading participants were problems related to technological and organizational functions. The operational work of international exchange participants was focused against the backdrop of recent instability and increased control by global politicians.

The Futures Industry Association cites in its reports the following promising areas for the development of international exchange activity:- growth in the volume of exchange trading in derivative contracts and commodity and financial assets;- increased demand for exchange instruments in the context of the continuation of the war in Ukraine and the Israel-Gaza war;- creation of favorable conditions for financial provision with credit resources;- expansion of the range of services for exchange traders;- growth in the share of financial derivatives trading in the overall structure of international exchange trading;- achieving a new record in the volume of international exchange trading;- implementation of artificial intelligence in exchange procedures;- tokenization of exchange instruments and the spread of new innovative solutions.The problems that still face exchange participants, as in previous periods, include:- overcoming wars and military conflicts and establishing integration relationships of an organizational and regulatory nature;- strengthening the fight against the main factors of instability at the global and national levels;- liberalization and unification of the regulatory framework at the global level;- improving the ways of accumulation and transfer of free capital.The analytical report of the Futures Trading Association indicates that in 2023 the main problems faced by exchange trading participants were problems related to technological and organizational functions. The operational work of international exchange participants was focused against the backdrop of recent instability and increased control by global politicians.

4. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу