3. Leading exchanges in the US and Canada

Commodity and stock exchanges registered in North America, in particular in the USA and Canada, occupy an important place in the history of the formation of international exchange activity.

Each country in North America has its own stock and commodity exchange of international importance and several other trading exchange platforms that are among the leading in international ratings.

The role of American exchanges, in particular commodity exchanges, began to grow at the end of the 19th century and this role has not changed on a global scale to this day.

The following were included in the list of major exchanges in North America in 2024, according to the Futures Industry Association:

- Intercontinental exchange;

- CME Group;

- NASDAQ;

- CBOE Global Markets;

- TMX Group;

- Bitnomial exchange;

- Fair X;

- Ledger X;

- Miami International Holdings;

- EEX Group;

- North American derivatives exchange.

From the above list, most of the listed exchange alliances, which unite several commodity and stock exchanges. In addition, there are electronic exchange platforms, which were previously over-the-counter platforms. Among the specified list are also cryptocurrency exchanges.

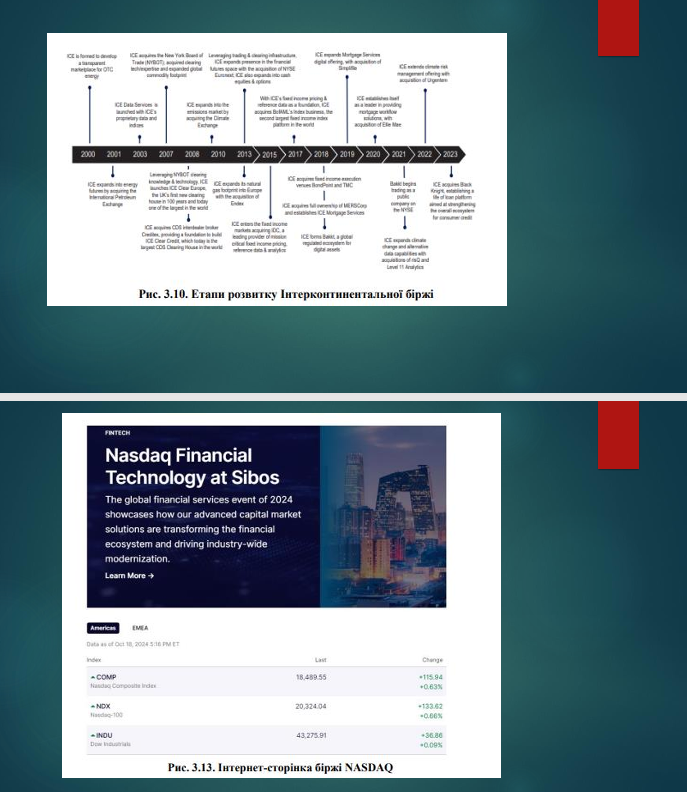

Intercontinental Exchange (ICE) was founded in 1997 through the purchase of a technology startup for $ 1, which was intended to provide transactions in energy markets.

During the first three years of 1997-2000, the platform worked on the development of web technologies for organizing

electronic trading in energy markets. During this time, the exchange worked on attracting leading market participants of various types of energy resources to its platforms, who sought transparency and neutrality of the electronic exchange platform.

The Intercontinental Exchange is now a major player in the major international organized commodity and financial markets.

In May 2000, a new trading platform, the Intercontinental Exchange (ICE), was launched. This name encouraged its integration on an intercontinental level, attracting new trading venues and international investors of a global level. As a result, today more than 70 countries around the world participate in exchange transactions on the exchange, including participants from the UK, the Netherlands, Singapore, Canada and the USA.

In 2001, the Intercontinental Exchange gained access to clearing when the London International Petroleum Exchange (IPE) sought to move from floor trading to electronic trading. At that time, IPE was a regional exchange offering oil futures contracts and had less than a 25% share of the global oil futures market. Virtually all of IPE’s trading volume was conducted through the trading floor, which was located opposite the Tower of London. At the same time, IPE’s owners, who were mostly energy companies, were watching developments at the London International Financial Futures and Options Exchange (LIFFE) and seeing how rapidly technology was transforming their markets. This created a heightened sense of urgency and understanding of the technological requirements to become a global marketplace in the Internet age.

Following the completion of the acquisition of IPE, now known as ICE Futures Europe, the exchange quickly set to work on two key projects. The first was the development of new cleared swap products, which began trading in 2002, well before the importance of clearing was more widely recognized. The second was the construction of electronic futures and options markets on the ICE trading platform, which dramatically increased the former IPE's share of oil futures trading volume and transformed it from a regional to a global exchange.

In February 2005, the Intercontinental Exchange successfully transitioned the IPE crude oil and petroleum products markets, which included Brent and Gasoil futures, to the electronic exchange platform.

The acquisition of the International Petroleum Exchange (IPE) was important for ICE, as the exchange’s primary objective was to expand the number of energy contracts. As a result, London’s role as a global energy trading market center increased.

In 2006-2007, ICE acquired the American New York Mercantile Exchange (NYBOT), and also gained the opportunity to use the clearing system of this exchange, which is now called ICE Clear US, and expand the global market for its commodity assets - sugar, cotton, coffee. The exchange spent $ 1 billion on this purchase.

In Europe, the exchange also created a clearing board, ICE Clear Europe, in London. London was an obvious choice, given the location of global energy markets, as well as the need for additional clearing settlements. Shortly after the launch of this system, the exchange launched a clearing model for European credit default swaps (CDS), which has a separate risk structure, guarantee fund and management.

Today, ICE operates six clearing houses around the world. In December 2014, the exchange acquired a controlling stake in ICE Clear Netherlands, providing a comprehensive clearing infrastructure in continental Europe.

Over the past 15 years, ICE has invested more than £4 billion in its UK operations. This investment has been accompanied by growth in UK revenues, which have increased 10-fold over the same period to approximately $1.4 billion in 2015, equivalent to an approximate annual growth rate of 30% per year.

In 2010, the Intercontinental Exchange acquired the Climate Exchange, expanding its range of exchange-traded contracts and introducing innovative exchange-traded futures contracts. These were related to climate change.

In 2013, a global event occurred as Intercontinental Exchange acquired one of the largest stock exchanges in the world, the

New York Stock Exchange. Using the trading and clearing infrastructure for ICE, it expanded its presence in the financial sector with the acquisition of the NYSE, adding financial instruments to its platforms, including stocks, bonds, and stock indices.

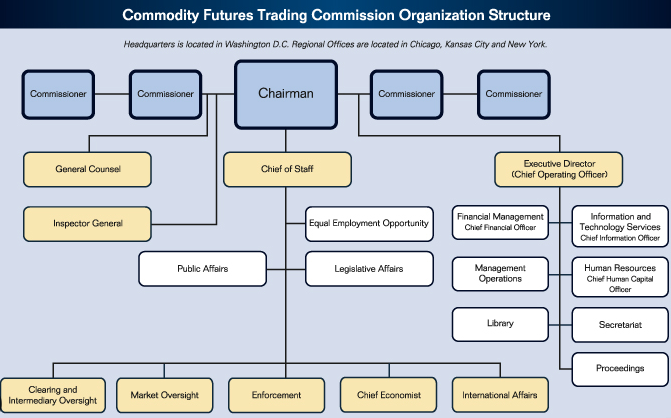

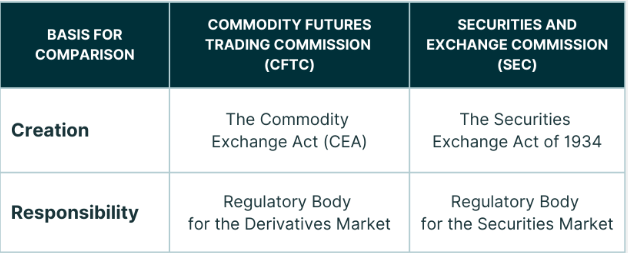

American exchanges differ from European ones in that they have their own clearing houses to serve their clients.

The clearing house requires margin payments from both

buyers and sellers. The amount of margin payments for each type of futures contract and for different assets is determined individually, taking into account the price volatility of a particular asset. Trading volumes on exchanges are determined by the number of contracts concluded per year. In 2023, 6.1 million contracts were concluded, which is 4% higher than in 2022.

The average rate per contract is defined as the ratio of the total clearing and transaction fee to the total volume of concluded contracts.

The main

indicators of the Chicago Mercantile Exchange (CME) are the average daily rates of concluded transactions for various types of assets. The highest figures were recorded for financial assets - 12.5 million contracts per day in 2023.

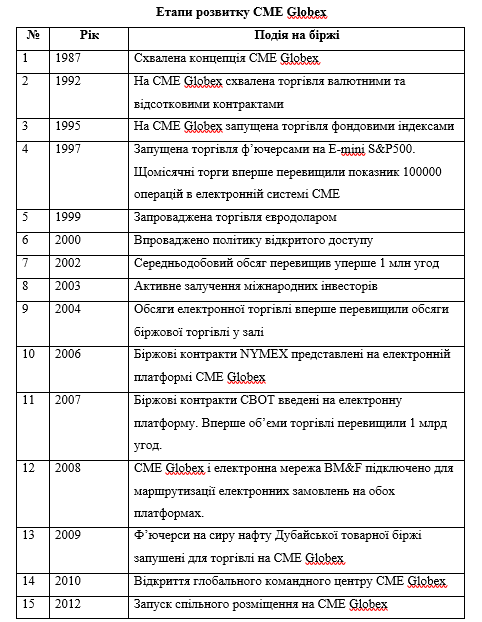

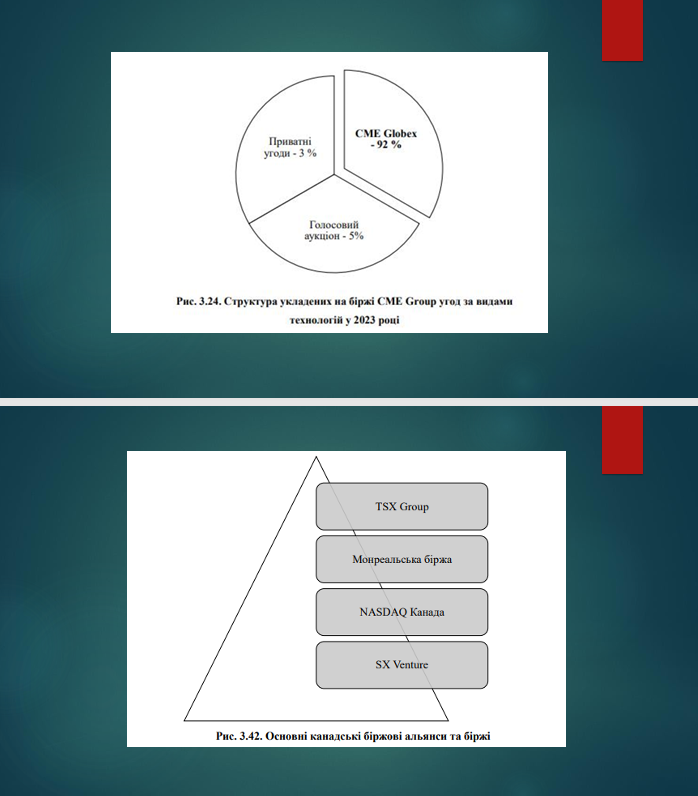

The main share of exchange trading is made up of transactions concluded on CME Globex - 92% in 2023.

The activation of trading on the Chicago Mercantile Exchange in the field of the electronic exchange system has increased significantly in the last 30 years due to the popularization of this electronic trading technology. It should be noted that at first it was actively used by stock intermediaries - brokers, and over time they allowed their clients to connect to it.

The main indicators of the effective operation of the electronic system are the speed of execution of transactions on it. More than 150 million transactions can be concluded on the Chicago Stock Exchange every day, or each transaction takes 6 milliseconds.

Electronic trading technology is the most advanced trading system currently on all leading exchanges in the world. Online trading is quite widespread and popular among investors at the national and international level.

It should be noted that the open voice auction in the halls of New York and Chicago has ceased to operate since 2018.

The Chicago Mercantile Exchange Group currently provides trading in a variety of commodity and financial assets.

As we can see, today the following types of assets are offered on the exchange:

- grains and oilseeds;

- meat of various types in frozen form;

- various types of dairy products;

- industrial assets;

- timber;

- energy resources;

- metals.

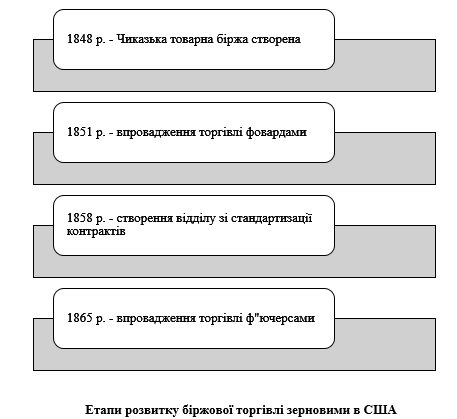

Commodity derivatives on the above commodity assets, now after a long evolution, have weeded out many goods that could not be stored for a long time and were not subject to standardization of parameters.

At the same time, the top 10 energy derivatives, in addition to oil, also include various types of gas and gasoline.

The quotation board contains various types of agricultural raw materials and semi-finished products. On the exchanges, futures contracts can be concluded for grain and oilseed crops, as well as semi-finished products, such as meat, powdered milk, butter, cheese, coffee, sugar, concentrated orange juice, etc.

Energy resources are the main types of commodity assets on the Chicago Board of Trade, among which the following types of oil can be listed:

- WTI crude oil;

- Brent crude oil;

- mini-futures on WTI crude oil;

- micro WTI;

- mini-futures on crude oil;

- micro-futures on crude oil.

The exchange also has a number of futures contracts for electricity.

The Chicago Mercantile Exchange offers a range of futures contracts for metals, including precious metals and non-ferrous metals. Precious metals include: gold, silver, platinum.

In addition to commodity assets, the Chicago Mercantile Exchange also trades in financial assets, namely:

- stock indices;

- exchange rates;

- cryptocurrency;

- other types.

The Chicago Mercantile Exchange also quotes international stock indices.

Exchange-traded foreign exchange rates on the Chicago Mercantile Exchange are carried out in various types of foreign currencies.

Interest-rate instruments became quite popular on international exchanges at the end of the last century. This market is associated with debt instruments, in particular bonds, treasury bills, etc.

An important role in ensuring the exchange trading of futures contracts was played by the introduction of option contracts on the Chicago Mercantile Exchange. Options, unlike futures, provided the right but not the obligation for buyers.

An important feature of options is that options can be implemented on exchanges only after the implementation and establishment of liquid trading in futures contracts for various types of assets. Therefore, exchange options are tied to their exchange underlying assets, which are futures contracts for various types of commodity and financial assets.

Innovative instruments on the Chicago Mercantile Exchange were introduced several years ago by futures contracts for the main types of cryptocurrencies, namely Bitcoin and Ether.

Given that Bitcoin is one of the most popular cryptocurrencies today, the Chicago Mercantile Exchange has provided the possibility of quotations in US dollars and Euros.

Given that Bitcoin is a fairly valuable exchange asset, for the convenience of investors, the exchange has provided trading in mini-futures contracts.

Exchange-traded cryptocurrency futures can be used effectively to hedge price risks in the over-the-counter cryptocurrency market.

In 2020, the Chicago Mercantile Exchange introduced trading in options on cryptocurrency futures.

The appendices provide some examples of exchange quotes and specifications of the Chicago Mercantile Exchange. CME Group remains the leading derivatives market on a global scale. The advantages of the exchange are:

- high exchange reputation and customer trust;

- efficient settlement and clearing system;

- high liquidity of concluding and executing exchange contracts;

- development of new innovative instruments.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу