Topic. 4: European Stock exchanges

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 4: European Stock exchanges |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:45 |

1. Common features

|

Nasdaq. Inc. |

|

Nasdaq Global. Inc. |

|

NasdaqHolding AB |

|

Nasdaq Clearing AB |

|

Nasdaq Stockholm AB |

|

Nasdaq Oslo ASA |

|

Nasdaq Helsinki Ltd |

|

Nasdaq Denmark AS |

|

Nasdaq Riga AS |

|

Nasdaq Copenhagen AB |

|

Nasdaq Iceland ht |

|

Nasdaq Vilnus |

|

Nasdaq Tallinn AS |

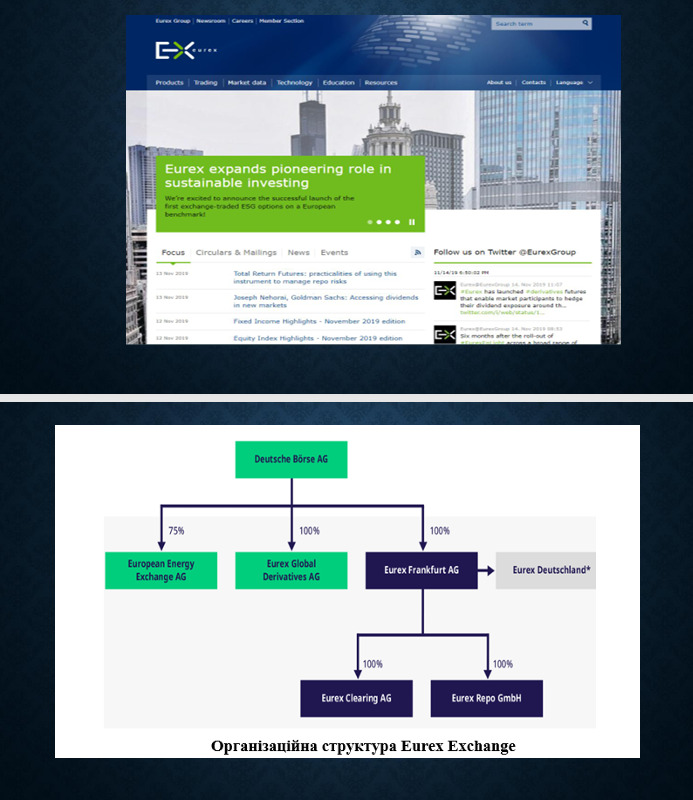

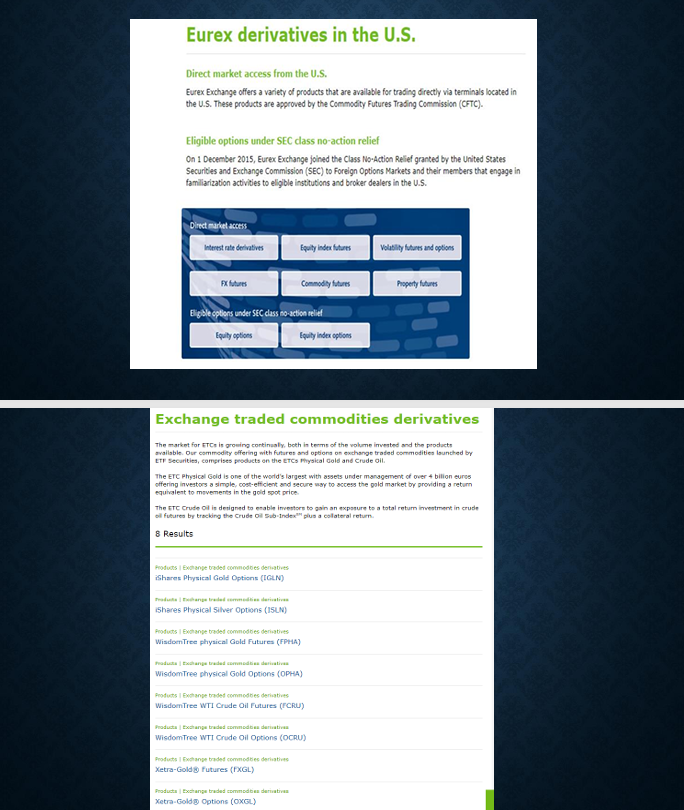

2. EUREX

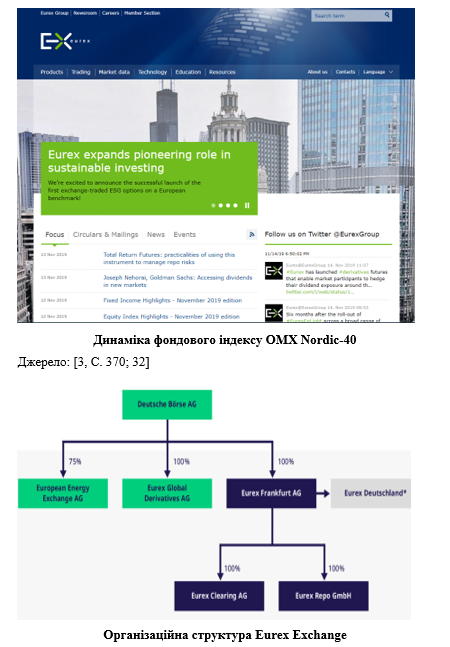

3. London Stock Exchange

4. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу