3. Argentine exchange MatbaRofex

Rosario Futures Exchange MatbaRofex was founded in 1907. This exchange is a member of the Futures Industry Association and at the end of 2024, the volume of transactions concluded on it amounted to 85.8 million contracts, which moved it to 2nd place in the ranking of exchanges in South America.

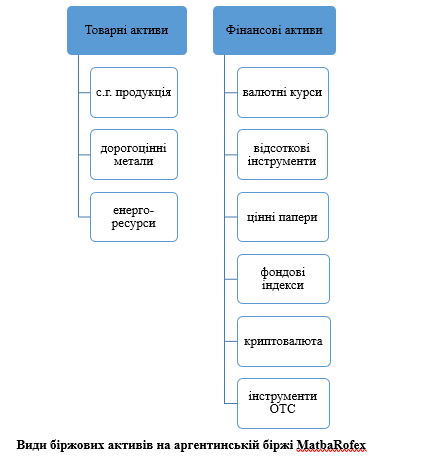

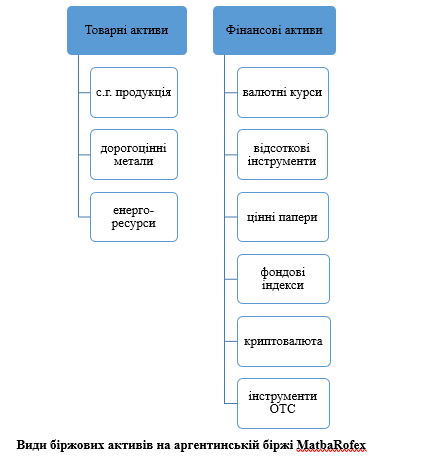

The MatbaRofex exchange provides trading in futures and options on commodity and financial assets.

Previously, the exchange was known as ROFEX S.A. in 2019 it changed its name to MatbaRofex.

The organizational structure of the exchange indicates that this exchange has 2 main organized markets and administrative management for them, namely the agricultural market and the financial market. Other departments of the exchange are similar to the typical organizational structure of the exchange.

The Argentine stock exchange Matba Rofex S.A., like other exchanges, also lists its shares in order to attract investment funds.

The Argentine stock exchange Matba Rofex S.A. currently provides trading in spot contracts and derivatives, namely futures contracts and options on futures for commodity and financial assets.

The peculiarity of the exchange is that it combines trading in agricultural assets and various financial assets on its platforms.

It should be noted that in the last two years, the

indicators of the total income of the exchange and the net income of the Argentine stock exchange have increased significantly.

The Argentine stock exchange Matba Rofex was created as a result of the merger of two stock markets with a century-old tradition of exchange trading in commodity and financial assets and derivative contracts, namely: Mercado a Término de Buenos Aires S.A. and ROFEX S.A.

The exchange provides trading in a wide range of commodity assets, including the following:

- agricultural products (soybeans, wheat, corn, Chicago soybeans and corn, barley, sunflower, sorghum, cattle meat)

- metals (gold);

- energy resources (WTI crude oil);

The Argentine stock exchange ROFEX S.A., like most international exchanges, carries out exchange trading in financial assets, namely:

- securities;

- stock indices;

- interest rates;

- exchange rates;

- cryptocurrency;

- OTC instruments, etc.

The Argentine exchange Matba Rofex is licensed by the National Securities Commission. The exchange has the ability to provide trading in spot and futures contracts. The exchange provides access to analytical information on its website for transparency and accessibility to other participants.

The exchange also includes other structural divisions, as well as companies with which it cooperates and has close organizational relationships:

1) The Clearing House, which is licensed by the National Securities Commission and provides services for registration, clearing, settlements, guarantees and storage of securities in the depository.

2) Primary - a company that develops high-performance technologies for markets and their participants, was created after the merger of Primary S.A. and Sistemas Esco S.A. The main goal of the company is to provide a full cycle of access,

electronic trading, risk management, etc.

3) Lumina Americas is a software company specializing in programming, development and implementation of solutions for financial markets, licensed to operate in South America;

4) Nexo ALyC is a comprehensive settlement and clearing agent regulated by the National Securities Commission and provides administrative and settlement services to trading agents.

5) Matba Rofex Foundation is a foundation that promotes research, development and educational programs in stock market activities. Its mission is to promote financial and economic education.

6) Primary Ventures is a company that invests in technology products. It supports startups in South America that are aimed at effective operation in capital markets. It especially finances new projects - on cryptocurrencies and their use.

7) UFEX is a stock exchange licensed by the Central Bank of the Eastern Republic of Uruguay, which provides trading in securities and foreign exchange rates.

According to the financial reports of the Argentine Stock Exchange in 2023, the fundamental factors that influenced its work were noted, namely: economic, social, regulatory, environmental.

During the reporting period, the exchange sold 396.5 million financial futures and options, which is 101% higher compared to the previous year.

Among the main ones were futures contracts on US dollars, which increased to 199.4 million contracts or 44.5% higher than the previous year.

Exchange trade in agricultural products for 2022-2023 amounted to 60.5 million tons, which is 7% less than the previous period. The number of open positions for the year also fell by 17.3% to 6.2 million tons per day.

The turnover of agricultural futures and options also tended to decrease. In the structure of trade, futures and spot contracts accounted for 85.79% or 51.9 million tons (-4.69%), and options - 14.21% or 8.6 million tons (-18.88%).

4.6 million tons were delivered under spot contracts during the reporting period, which is 8% less than in the previous period.

If we consider the structure of agricultural products sales with delivery, the following were delivered:

- soybeans - 2.3 million tons (+14%);

- wheat - 0.8 million tons (-35%);

- corn - 1.6 million tons (-16%).

Given the complex macroeconomic content, the Matba Rofex exchange currently considers its main priority to invest in the development of new financial instruments in order to attract new investors.

The next step is to deepen cooperation with the Uruguayan UFEX exchange in the medium and long term.

As we can see, last year was not so favorable for trading in agricultural products. During this period, droughts were observed, which affected the reduction in yields. Economic instability and reduced yields contributed to the additional need for hedging. Therefore, in the long term, an increase in exchange trading in derivatives on agricultural products is expected.

The exchange is also working to improve trading in spot contracts on agricultural products.

It should be noted that the acceleration of inflationary processes, the increase in the consumer price index to 115.6% led to an increase in exchange trading in futures and options on foreign exchange rates by 50%.

Innovative steps in 2023 include the introduction of futures trading on the cryptocurrency exchange – Bitcoin in Argentine pesos.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу