Topic. 7: International stock exchange associations

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 7: International stock exchange associations |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:51 |

1. The Commission and commercial activities in the stock market.

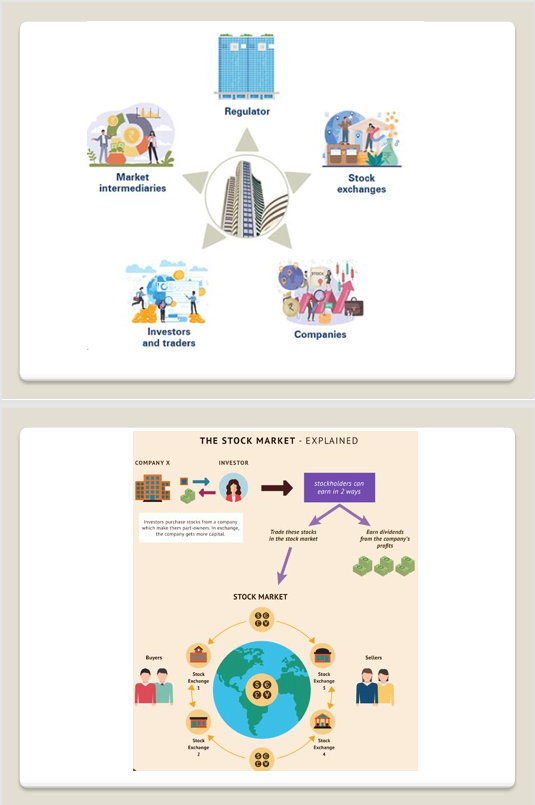

To reduce the risk of failure to determine the market price and the choice of partner for operations with securities in the stock market use the services of specialists or sales agents.

The most common among these representative agents in the stock exchange market are brokers.

Brokering activities - activities aimed at the conclusion of securities transactions based on contracts commission.

A stock broker is an agent who represents clients to buy or sell stocks and others securities.

A broker acts as an intermediary acting on behalf of the client and gets rewarded with a commission.

Giving the order to the broker, the client concludes with a written agreement, which defines all the basic characteristics of the future agreement.

Under the law, at the conclusion of the agreement on behalf of the client, the broker should not have their interest in such a deal.

In the commission of the stock market acts which are commercial brokerage or dealership.

Dealer carries out transactions on their behalf or at their own expense.

Such activities usually have a speculative nature where the aim is not just a dealer buying and selling of securities, and profit by reselling them successful.

The dealer may also act as broker, in addition to performing their operations and customer orders.

In such cases, the operations to be performed on behalf of the client will be prioritized and only after the service broker dealer may work on their behalf.

2. Using Day-trading in stock markets.

Day trading – the act of buying and selling a financial instrument within the same day.

During the day, the player closely tracks the rise and fall in elected securities purchases and sells them, trying to cash in on exchange rate fluctuations. At the end of the trading session, a player sells all the securities the next day to start again.

The term of one trading session due to the fact that while the trader is to exchange it, following the situation, the devaluation of existing securities it will always be able to immediately get rid of them.

In this way it will reduce their losses to a minimum. If the securities remain in the Trader after the close of trading, there is the risk of a significant reduction in their rate of discovery to the next exchange.

Thus, the trader losses grow, and he will not be able to stop them getting rid of unprofitable securities.

The signal to close the position may be a situation where the difference between the minimum or maximum and current price during the session is the average amplitude of the instrument.

Usually this is typical for day extremum and prices likely will dramatically change.

Day Trading Tips You Need to Know:

1) Knowledge is Power

Not just knowledge of basic trading procedures, but of the latest stock market news and events that affect stocks – the Fed's plans for interest rates, the economic outlook, etc. Do your homework; make a wish list of stocks you'd like to trade, keep yourself informed about the selected companies and general markets, scan a business newspaper and visit reliable financial websites on a regular basis.

2) Set an Amount Aside

Assess how much capital you're willing to risk on each trade (most successful day traders risk less than 1-2% of their account per trade). Set aside a surplus amount of funds that you can trade with and are prepared to lose (which may not happen) while keeping money for your basic living, expenses, etc.

3) Set Aside Time, Too

Day trading requires your time – most of your day, in fact. Don’t consider it as an option if you have limited hours to spare. The process requires a trader to track the markets and spot opportunities, which can arise any time during the trading hours. Moving fast is key.

4) Start Small

As a beginner, it is advisable to focus on a maximum of one to two stocks during a day trading session. With just a few stocks, tracking and finding opportunities is easier.

5) Avoid Penny Stocks

Of course, you're looking for deals and low prices. But keep away from penny stocks. These stocks are highly illiquid and chances of hitting a jackpot are often bleak.

6) Time Those Trades

Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, contributing to price volatility. A seasoned player may be able to recognize patterns and pick appropriately to make profits. But as a newbie, it is better to just read the market without making any moves for the first 15-20 minutes. The middle hours are usually less volatile while the movement begins to pick up towards the closing bell. Though the rush hours offer opportunities, it’s safer for beginners to avoid them at first.

7) Cut Losses with Limit Orders

Decide what type of orders you will use to enter and exit trades. Will you use market orders or limit orders? When you place a market order, it is executed at the best price available at the time; thus, no “price guarantee.” A limit order, meanwhile, does guarantee the price, but not the execution. Limit orders help you trade with more precision wherein you set your price (not unrealistic but executable) for buying as well as selling.

8) Be Realistic About Profits

A strategy doesn't need to win all the time to be profitable. Many traders only win 50% to 60% of their trades. The point is, they make more on their winners than they lose on their losers. Make sure that the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written down.

9) Stay Cool…

There are times when the stock markets test your nerves. As a day trader you need to learn to keep greed, hope and fear at bay. Decisions should be governed by logic and not emotion.

10) …And Stick to The Plan

Successful traders have to move fast – but they don't have to think fast.

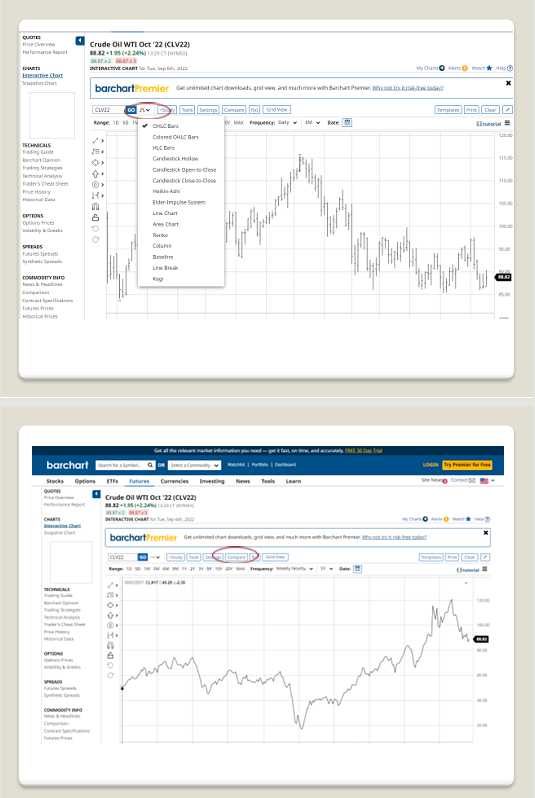

Previously, we mentioned three tools for determining entry points – that is, deciding the opportune moment you're going to buy a stock (or whatever asset you're trading). The most technical are intraday candlestick charts. We'll focus on these factors:

- Candlestick patterns, including engulfings and dojis.

- Technical analysis, including trendlines and triangles.

- Volume, as in increasing or decreasing volume.

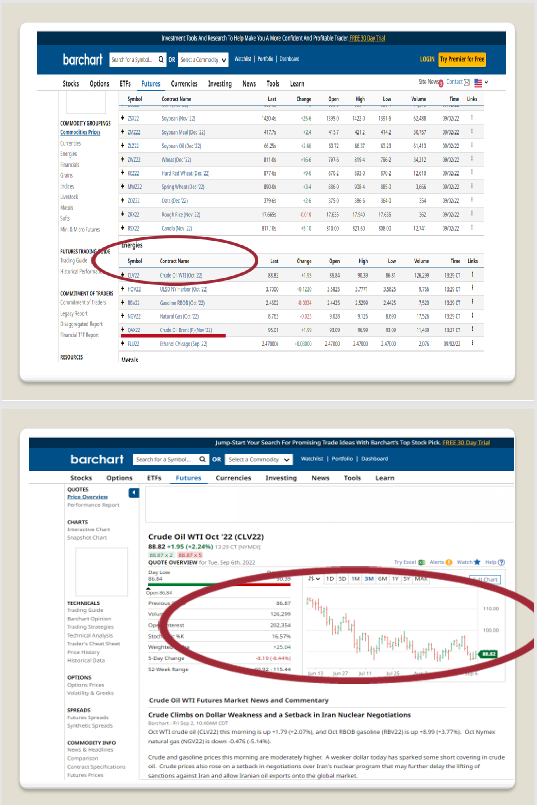

3. Internet-trading.

Currently, the stock and currency markets have become more available to private investors.

This is possible because of the Internet and the emergence of so-called online brokers.

Full Internet services (including financial) is a full-service, using all possible distinctive features of the Web as a new medium of communication.

The first method because of its technology restricts the presentation of financial information for the client. In the second case, the user can customize the interface for themselves, build schedules, receive only the information that he needs, etc.

Internet trading facilitates purchases and sales of securities on the stock exchange in the real-time mode through universal brokerage system interface and allows for instantaneous response to changes in market conditions, without the need to directly connect to the broker.

Internet trading is the way of access to trading on the stock exchange using the Internet as a means of communication.

In recent decades, this method of trade has become very widespread. Internet-trading emerged due to the "Ukrainian Exchange" relatively recently. So far, not all are familiar with the possibilities of Internet trading, as a way of investing and multiplying their capital. However, already at this stage of development of our country, this service has become the best alternative to bank deposits, purchase of real estate for preservation and increase of personal capital. This means that today everyone can buy and sell shares, earning on it - and this is nothing more than Internet trading.

.The emergence of Internet trading in Ukraine

Some even now represent the stock exchange in the form of an "exchange pit" - a large hall where men emotionally waving some papers and showing each other something on their fingers. Those times have long since sunk into oblivion, and the noise of agitated traders on the trading floor has grown into the noise of servers in exchange offices around the world. That is, investors got the opportunity to trade on the exchange, seeing everything that happens on it, independently making decisions, and instantly concluding deals without leaving their own home, office. In 2009, after the launch of the Ukrainian Exchange, Internet trading appeared in Ukraine.

Benefits:

Internet trading has several strong arguments in its favor:

- an acceptable cost of sales;

- high liquidity;

- transparency of transactions and low spreads (the difference between the best purchase and sale prices at the same time for any asset (stocks, futures, options);

- Quick opening of the account with the minimum starting capital.

- Typically, access to trading is provided by an online broker. The online broker provides its customers with software for communication with the exchange for bidding and provides technical support for this activity. In this chain of interactions, the online broker is an integral part, it provides access to trading on the trading floor, i.e. on the exchange.

4. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу