Topic. 8: Internet-trading

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 8: Internet-trading |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:42 |

1. Prerequisites for the emergence of electronic commerce technology

International exchange activity and its development were closely related to the technology of trading on commodity and stock exchanges. Trade technology is closely related to the specialization of exchanges in international commodity and financial markets.

Exchange trading technology involves interconnected exchange transactions carried out by participants in organized markets. The organizational principles of international exchange trading depend on the evolution of trade technology. All exchange trading technologies had certain common features:

- expression of supply and demand at the national and global levels;

- establishment of a mechanism for providing intermediary services;

- coordination of existing organizational conditions of trading on exchanges between brokers and clients;

- streamlining of the clearing and settlement procedure;

- establishment of processes for storing and delivering underlying assets.

Market depth indicates the number of underlying assets available on organized markets. This indicator can clearly show the level of development of exchange trading technology. On the other hand, the presence of standardized assets, primarily raw materials and semi-finished products, indicates the current level of development of organized commodity and financial asset markets.

Market width - indicates the number of exchange participants involved in the execution of exchange transactions in exchange trading systems. A high number of participants is a positive factor indicating increased exchange liquidity.

Spread - an indicator of the difference in prices between buyers and sellers on organized markets. There are always two prices on exchanges - the buyers' price and the sellers' price. The difference provides speculators with a price range that is used to build speculative exchange trading strategies.

The organization of exchange trading involves the development and improvement of exchange trading technology, which has evolved for a long time. The first trading technologies were closely related to the organization of trading on the exchange floor. Exchange trading is carried out in the form of auction trading. The auction provided the opportunity to qualitatively organize exchange trading in commodity assets on exchanges.

The first exchanges provided trading in their exchange floors based on the use of auctions, namely:

- simple auctions;

- absentee auctions;

- double voice auctions.

The next evolutionary stage in improving the technology of stock trading was the introduction of a double voice auction. During double voice auctions, stock market participants have the opportunity to use their voice and sign language to conduct high-quality trading in stock market assets.

A double voice auction is conducted according to the established rules of stock market trading. Brokers in the stock market halls shouted out their clients' orders during the trading session, and stock market employees recorded them, after which the transactions were considered open.

Contracts concluded on the stock market must be registered during the trading session, otherwise they will be considered over-the-counter. Preliminary registration of the transaction is carried out by filling out an application for the purchase or sale of stock market contracts. Transactions are registered within the time limits established by the stock market trading rules.

Brokers have the right to check the availability and quality of stock market assets, and at the same time, monitor the solvency of their clients. Sellers' brokers must act as guarantors in the event of delivery of the underlying assets.

The clearing department on commodity and stock exchanges sends payment documents to exchange trading participants. In this case, a clearing fee is charged to both exchange trading participants for clearing settlements.

2. Tasks and functions of the stock exchange.

Tasks and functions performed by the stock exchange concerning various spheres of society, so they can be distributed as follows.

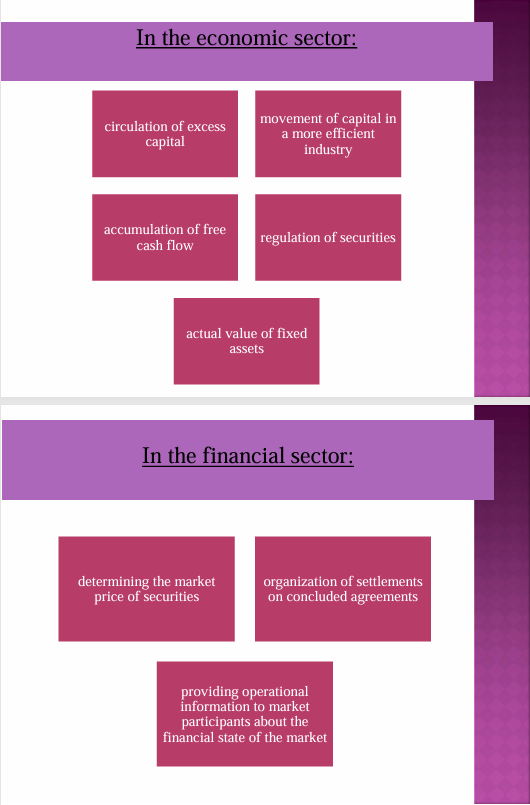

In the economic sector:

• accelerate the circulation of excess capital;

• movement of capital in a more efficient industry;

• accumulation of free cash flow;

• regulation of securities;

• Play the actual value of fixed assets.

In the financial sector:

• determining the market price of securities;

• organization of settlements on concluded agreements;

• providing operational information to market participants about the financial state of the market.

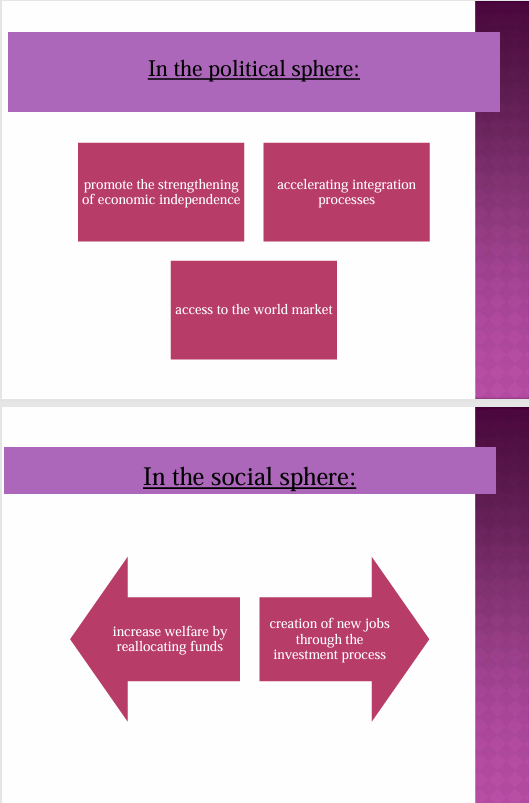

In the political sphere:

• promote the strengthening of economic independence;

• accelerating integration processes;

• access to the world market.

In the social sphere:

• increase welfare by reallocating funds;

• creation of new jobs through the investment process.

In the moral-psychological sphere:

• Formation of market psychology in the population;

• Formation of confidence in securities and transactions with them;

• prevent abuse and fraud in the stock market.

3. Structure of the stock exchange.

Management of the stock exchange provide exchange committee, elected from among its founders.

Exchange committee hired top managers, who form the executive directorate.

Exchange committee into general exchange and special.

General include: the secretariat, the Bureau of Communications, Department of Accounting, Human Resources, Administrative department, legal services, public relations department, archive.

Special departments include: registrar, Department quotation department listed companies, the Department of trading, Department of Information and market analysis, marketing department, department management system, department of trading systems, Department of storage and payment department of telecommunication systems, audit committee, budget committee , department for admission of new members, department for arbitration department listing and others.

The above organizational structure of the exchange is typical for most stock exchanges, but each individual exchange can have its own structure, which, though not essential, but will be different from the default.

4. The procedure of listing in internet trading

SecuritiesTrading on stock exchanges may occur, usually only those securities that have been specially checking the stock market. This test is called the listing and its result is the inclusion of securities is the list of which can be traded. That effectively means the listing admission to exchange trading.

Holding listing means deep and comprehensive inspection of the issuer in compliance with the requirements imposed by the exchange to those who wish to sell their securities because of the stock market. These requirements can be quite high and concern not only economic activities of the issuer and its business and reputation. Since such test involves the disclosure of a significant amount of information that the issuer does not always ready to disclose, the legal procedures listed by the State is not compulsory. However, the benefits that the issuer receives when entering the stock market is usually the reason that despite the voluntary listing, wanting him to go always enough.

Among the benefits that those who have passed basic listing is:

• High level of liquidity of securities due to enter the market as a strong stock;

• increasing the value of the securities as those that were listed, and therefore reliable for investors;

• improve their image by advertising their securities to be permanent, while they will trade;

• greater confidence to the issuer from banks and other financial institutions;

• reduction of inspections by tax authorities.

Thus, an investor who buys securities on the stock exchange can be confident in the reliability of information about them. However, it should be borne in mind that exchange, ensuring reliability securities do not guarantee their return.

In Ukraine today listing is not mandatory to enter the stock exchange. But on domestic securities exchanges still required to undergo certain checks are not as significant as in the complete listing, but enough so that the exchange could be responsible for information provided by issuers.

In particular, the Ukrainian stock exchange admission of securities carried out in three sections K1, K2 and K3. The section K1 traded securities issuers which meet the highest requirements of the domestic stock market. Sections K2 and K3 are securities corresponding lower order.

Securities Quotes - a mechanism to identify their market price, fixing it for a certain period, usually the day of the exchange and publication in specialized journals.

Since the exchange is concentrating in large quantities supply and demand determines the ratio between them, the price set on an exchange ratio based on this objective will be most at any given time and a given set of conditions.

Price at which concluded agreements with securities called exchange rate. Exchange rate is usually set benchmarks for the conclusion of agreements outside the stock exchange.

Quoted price is set based on the prices of all signed agreements and their volumes. This price is for reference purposes carry, giving an idea of what is happening in the stock market with one or other securities. Sets of special stock unit - Quotation Committee. In determining the prices quoted commission have to be guided by certain rules that the exchange rate is set at a level which provides the greatest number of transactions. also quoted Commission determines the upper and lower price levels, the opening price and closing price. This price excluding unusual for these trades.

From quoted prices usually start a new transaction exchange day.

This price determines the real value of the security, which will almost always be different from the nominal.

The excess of market price over the par value called Agio, exceeding the nominal value of the market rate - disagio.

Quotes securities to determine their real market rate can also authorized to exercise governmental organizations, specialized companies and banks.

5. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу