Topic. 9: Types of trading strategies

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 9: Types of trading strategies |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:41 |

1. Using of stock index in trading strategies

Stock indices have more than a hundred years used for the integrated assessment of the stock market.

Based on the exchange stock indices also possible to analyze the economic system as a whole.

Stock indices also allow investors to assess their portfolio. Almost all exchanges have their own system of aggregate indices that reflect the level and dynamics of prices.

Stock Exchange Index - a statistical average value calculated based on the exchange rate difference of securities included in the stock basket.

Stock indices are digital stats, expressing (usually a percentage) successive changes of certain phenomena. After a certain period of time the exchange difference stocks that make up the stock index recorded and used as the basis for calculation of these index values. Thus, the index is the ratio of comparable size to a certain value, which is taken as the base.

Each index has the following characteristics:

- List Index (set-share representatives);

- The method of reduction to the average;

- Types of scales to share prices;

- Basic index;

- Statistical base.

There are various types of indices, such as exchange indices calculated based on shares. Analytical company have in its arsenal, its indices. Indices may accrue as a large number of shares, and a small number. Stock indices are sometimes calculated as a weighted average, determined by considering not only the relative changes, but the absolute price of shares of companies that create the index basket. Yearly share price reflects the expectations of the exchange of the stock market because the stock indices can serve as a barometer of the future of the economic system. In world practice, using four methodological techniques for constructing indirect index changes of stock prices based on calculations for the corresponding period:

I. the rate of change of the arithmetic mean value of the share price of a number of selected corporations (Dow Jones)

II. the rate of increase (decrease) the arithmetic average (the number of shares outstanding) price of the majority shares of corporations (index "Standard and Poor" and "Uilshyr -5000");

III. serednoheometrychnoho value growth rate (decrease) equity prices;

IV. serednoheometrychnoho weighted rate of price change of shares (index "Velho Line").

The change index values typically viewed as an indicator of demand in the market. Rising or falling index in one market often affects the state of demand on the other.

Currently, the emerging economies are more than 200 stock exchanges. Almost each of them has its own system of stock exchange indexes.

The US regularly published data on 20 indices in Europe - 25 in Japan - on 3. Have your exchange indexes in Latin America and Asia. The most widely used in the world index, developed in the United States. This is due to the fact that the daily turnover of only the New York Stock Exchange (NYSE) for a long time was half the world's securities turnover.

The most famous and the very first index is the Dow Jones, which zvyvsya in 1884 as the average market value changes 11 big industrial companies. The idea of calculating exchange stock index belongs to Charles Henry Dow, who was then editor of "Wall Street Journal". Using this index could characterize the US economy as a whole. Apparently the idea was quite original and even now this index has been used successfully in the stock market of the stock of the New York Stock Exchange. Modern Dow has four options:

- Industrial index, which is calculated at the rate of 30 industrial companies;

- Transport index - an indicator of exchange 20 prominent transportation companies;

- An index for the 15 utility companies;

- Aggregate index, which is calculated on the basis of the above 65 companies.

Dow Jones is calculated as the arithmetic average of the rate of selected companies, namely as follows:

DJIA = Pi / D

where

Pi - course and first asset;

D - divider, which reflects the rotation companies and change the number of their shares. Today it is 1.5 points.

Equally well known is the American index Standard and Poor index - S & P 500, which includes 400 industrial companies, 20 vehicles, 40 financial and 40 public. The calculation of the index used by arithmetic average number of shares of the above mentioned companies:

S & P 500 = PiQi / Pib.Qib.

where

P - first rate and the asset;

Q - amount of the asset during a certain time.

For ease of use the index multiplied by 10 - base value.

Along with the above indices in the world uses a large number of stock indices, the most popular among investors and stock analysts is below these indices (tabl.9.1).

Thus, we can see that in the world practice, a large number of stock stock indices. Moreover, every country in the world in its use has several stock indices as exchange and OTC. All listed indexes are used in market research, the analysis of exchange trade, assessment of and prospects for the development of industries, etc. But for the organization of exchange trade must count the cash share price (current rate) on the basis of which is trade.

Stock indices are changing under the influence of a large number of factors:

• Economic and political stability;

• inflation;

• magnitude of interest on loans;

• Dimensions paid interest on deposits and dividends;

• risk investments;

• developing a network of financial institutions, their reliability;

• investment opportunities, etc.

The main requirements for the exchange of stock indices are:

• Change display exchange of shares on the stock exchange;

• vklyuchannya sufficient number of shares to adequately reflect the state of the stock exchange market;

• display the status of a particular issuer in equal conditions compared to other issuers whose shares are included in the index.

2. The main functions of stock indices.

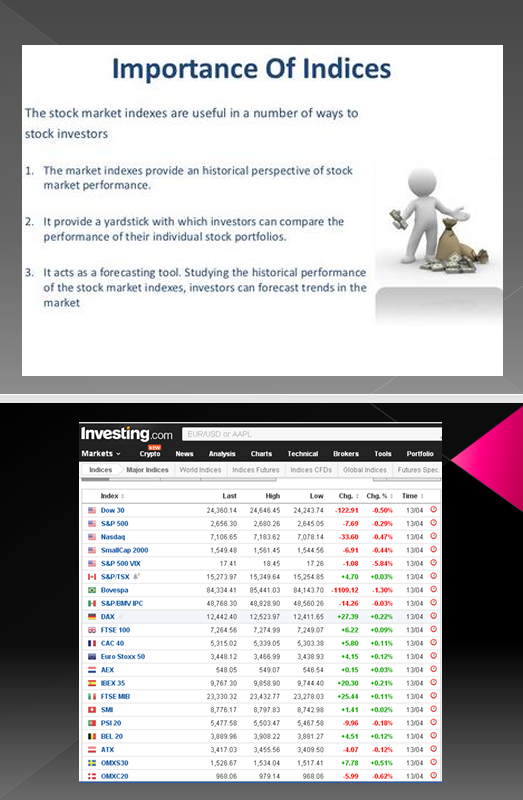

The role of exchange stock indices can be reduced to three functions:

1) diagnostics;

1) Indicative;

3) speculative.

During the diagnostic function should understand the system's ability to characterize the index status and dynamics of the national economy as a whole and its individual components. Change mechanism exchange stock index is very simple - growth or decline in profitability instantly displayed on the quoted price of the respective shares, which in turn affects the level of stock index field.

Stock exchange index is a means of demonstrating pace of the market. They allow investors and traders to see trends that develop in the market and track the speed of these trends.

Thus, the ETFs are index system of economic monitoring of the national economy.

Performance indices indicative function implies that the presence of an objective assessment of the situation in the stock price stock market provides a benchmark for evaluating the behavior of large investment funds, individual investors and portfolio managers. Calculating the dynamics of the market value of the portfolio of shares for any period of time, investors can make informed decisions, as chosen strategy is effective (portfolio index higher / lower than the exchange of stock or is it) and make adjustments to their behavior in the market, if needed.

Function speculative exchange stock indexes manifested in their use as the underlying asset at the conclusion of futures contracts and purchase options. To capitalize on this market, you do not own securities, concluding term agreements by changing the index during the day or other short-term period. The main characteristic specifications futures contract or an option to exchange the stock index is that it's only financial instrument that is no underlying asset for delivery and only used as a settlement contract. At the heart of grommets or option on stock index is calculated in the base areas, and the contract value is determined by multiplying the number of points on their cost. 1 particular item can cost 10, 100, 500 currencies. In particular in Russia and Ukraine this base is 10 rubles and 10 hryvnia. The features and advantages of speculation in futures and options on stock indexes to guarantee a high level and the possibility of transactions through the use of Internet trading, distribution has become much scope in recent years and the domestic stock market exchange.

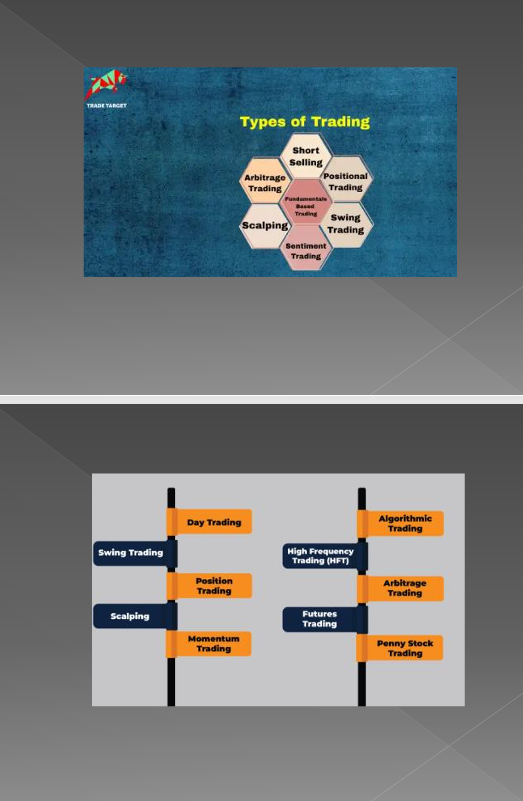

3. Speculative trading strategies

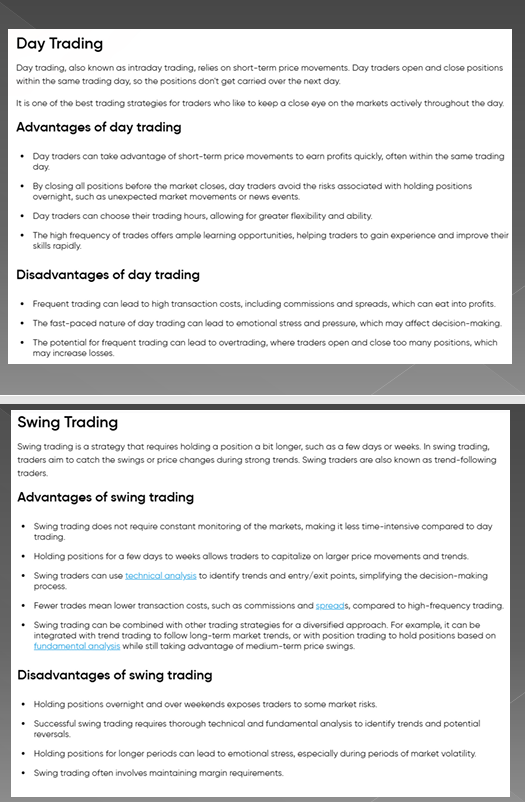

International stock exchange activity on organized commodity and financial markets involves the daily presence of high price and currency risks, which are attractive to a fairly large group of exchange participants, whose goal is to make profits from speculative trading strategies.

Speculators are now the main link in liquidity in international stock exchange activity.

Speculators assume most of the risks of other participants - hedgers and traders, and also multiply the size of investment capital on exchange platforms. Investment capital is quite important for ensuring effective circulation on organized markets and thereby increases the liquidity indicators of exchange trading.

With accurate and reasonable expectations about the future price situation, speculators on organized markets perform the following functions:

- assuming most of the price and currency risks;

- providing hedgers with the opportunity to freely and quickly enter and exit the stock market;

- changing the ratio of supply and demand to form an equilibrium price;

- ensuring the necessary indicators of the depth and breadth of stock markets;

- increasing the liquidity of stock market indicators recorded on electronic stock exchanges due to new participants and new types of stock transactions;

- the ability to simultaneously open positions for purchase and sale, taking into account the price exchange situation;

- smoothing price dynamics over time;

- analysis and forecasting market conditions and price trends on electronic stock exchanges.

The French classic of economic theory P. Proudhon was among the first researchers of speculative theories. In his work “A Guide for Stock Exchange Speculators” (1857), he argued that the basis of production and reproduction of wealth consists of quite important components:

1) labor - the process of producing things, cultivating the land, smelting iron;

2) capital - investing money in trading activities;

3) speculation - the most important factor that is the basis for innovative production and the development of new technologies.

Production is an important process that creates additional values and attempts to give additional value to things for the purpose of their effective implementation in organized markets.

4. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу