Topic. 10: Cryptocurrencies derivatives

| Сайт: | Навчально-інформаційний портал НУБіП України |

| Курс: | International Exchange Activities ☑️ |

| Книга: | Topic. 10: Cryptocurrencies derivatives |

| Надруковано: | Гість-користувач |

| Дата: | понеділок, 9 березня 2026, 15:42 |

1. History of cryptocurrency

Cryptocurrency is an innovative instrument or digital or virtual currency that uses cryptography for security, making it difficult to counterfeit. Cryptocurrencies are decentralized and are developed based on blockchain technology.

The concept of digital currencies dates back to the 1980s, when early pioneers in the industry, such as David Chaum, introduced secure electronic cash systems such as eCash.

The modern era of cryptocurrencies began with the launch of the now-famous Bitcoin, which was launched in 2009. As of 2023, there were about 19 million Bitcoins in circulation.

Bitcoin is officially attributed to its first mention in 2008 by Satoshi Nakamoto. A white paper titled “Bitcoin Peer-to-Peer Electronic Cash System” details the concept of a decentralized digital currency that can be sent from one participant to another without the need for an intermediary.

Starting in January 2009, Satoshi Nakamoto mined the first Bitcoin blockchain, the Genesis Block. This is considered the first beginning of the existence of the world’s most famous cryptocurrency and one of the most expensive.

After the successful use of Bitcoin, several other cryptocurrencies or altcoins emerged. Litecoin, which was launched in 2011, was one of the first altcoins. It was followed by others, such as Ripple (now XRP) and Ethereum. These altcoins aim to improve upon blockchain technology by offering faster transaction speeds, enhanced security features, and different consensus mechanisms.

ISO coins were subsequently proposed, with their popularity particularly notable in 2016 and 2018, allowing a large number of startups to raise funds through the issuance of their own tokens. Although many ISOs were legal, the lack of regulation led to numerous scams, which severely tarnished Bitcoin’s reputation.

As cryptocurrencies gained popularity, regulators around the world began to study their impact on financial markets and their stability, consumer protection, and the prevention of money laundering. Regulatory approaches varied, including different directions in each country:

- amending and implementing regulations on cryptocurrency trading;

- banning cryptocurrencies;

- partially restricting the use of cryptocurrencies.

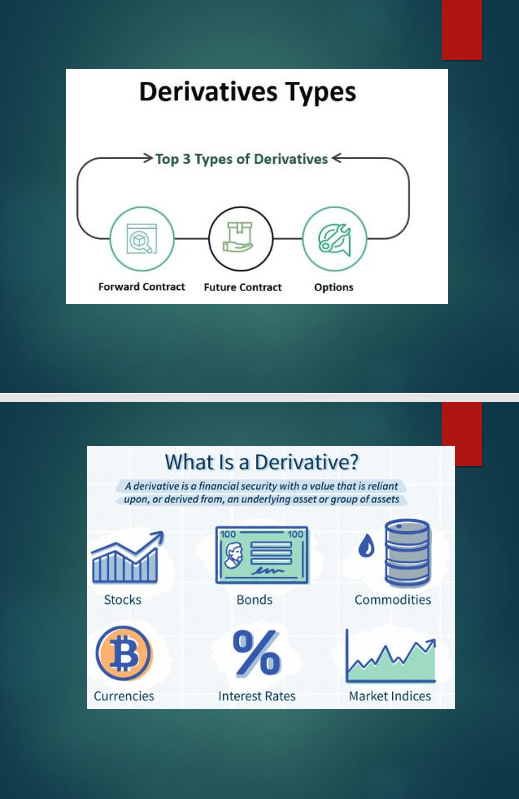

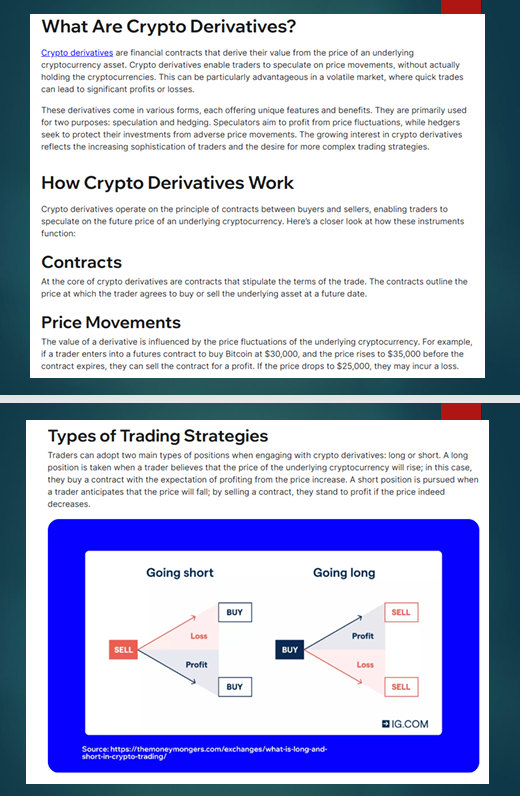

2. Derivatives and their types

3. Exchange trading of cryptocurrency derivatives

4. Presentation

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу