Topic 6. Stock exchanges in the Asian region

3. Developing stock markets in the Asian region

The Asia-Pacific stock market region has been playing a significant role in international stock market activity in recent years.

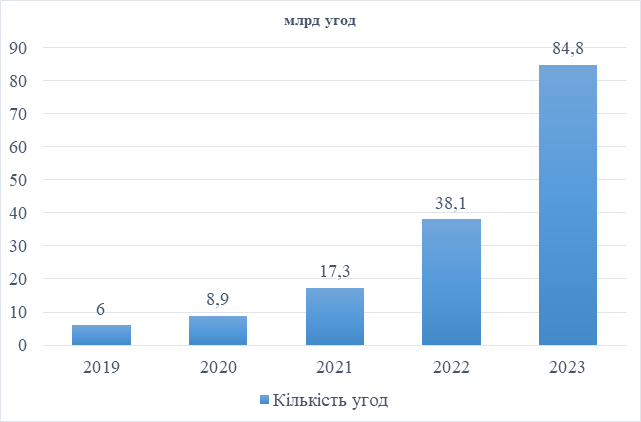

The National Stock Exchange of India has been ranked first in the top 10 international stock markets in recent years. The volume of stock market trading on this exchange has increased dramatically in the last five years and in 2023 recorded a new level of 84.8 billion transactions, which is 14 times higher than in 2019.

The National Stock Exchange of India was founded in 1992 and is located in Mumbai. It is currently one of the three largest stock exchanges in the world, along with the American stock exchanges NYSE and NASDAQ [44].

In 1995, the National Stock Exchange of India introduced a fully automated electronic trading system. Today, there are over 2,200 issuers on the exchange. Several key stock indices, the Nifty 50, CNX 100 and CNX 500, are listed on the exchange, as well as the FMCG index for IT companies.

The National Stock Exchange of India has an integrated electronic business model that includes a listing, clearing and settlement services, stock indices, information resources, technology solutions, etc. The exchange also supervises compliance with trading and clearing procedures, which are listed in the trading rules and regulations of the exchange.

The National Stock Exchange of India is a leader in innovative solutions, as the exchange adds new types of investment instruments every year.

In 2003, the exchange made another technological breakthrough by launching retail trading on its electronic platforms. This allowed it to attract a large number of small investors to trade securities. The main advantage was the ability to not visit the exchange to conclude transactions.

In 2009, the National Stock Exchange of India proposed two important initiatives to expand the circle of its users. First, it launched the Mutual Fund Service System (MFSS), which simplified the management of mutual funds. Second, the exchange launched trading in derivative contracts on stock indices, which allowed exchange trading participants to better use them in managing price risks and investing free cash.

In 2010, the stock exchange introduced a draft depository receipts based on an already operational electronic trading system, which allowed interested foreign companies to raise capital on the Indian stock market through IPOs. The same year, the National Commodity & Derivatives Exchange Limited (NCDEX) was launched for trading commodity derivative contracts.Despite their long history and long-standing practice, Chinese exchanges have become competitive in international stock markets in the last ten years.

The Shanghai Stock Exchange is included in the ranking of the 10 largest exchanges. Shanghai has historically been a city - a financial center for securities trading in China.

In 1920-1921, the Shanghai Stock Exchange began its activities, which also attracted foreign investors to trade. The exchange provided the opportunity to trade in debt obligations, government bonds and financial futures [45].

Since the 1980s, stock trading in China has developed in tandem with the reform of the country's economic system. In 1984, corporate bonds appeared in Shanghai. Today, the Shanghai Stock Exchange has become a growing market for international stock trading.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу