The history of the American

stock market dates back to the early 1800s, when Chicago became an important center for the sale, storage and redistribution of agricultural products, in particular grain. As mentioned earlier, Chicago played an important role due to its convenient logistical location.

The development of international

stock trading, the emergence and evolution of stock trading technology were closely related to the formation of our civilization, changes in production technologies, the emergence of an organized form of trading in goods and

financial assets.

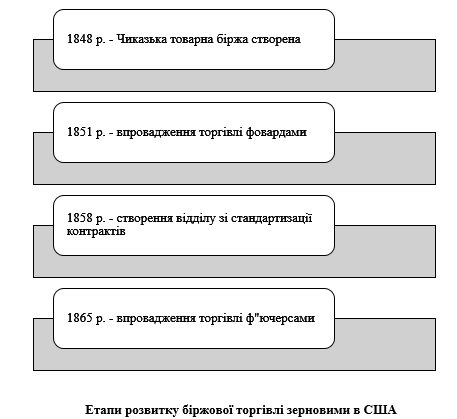

In 1848, a significant event took place - the now world-famous commodity exchange and derivative contract exchange were opened in the United States, which was founded by a group of traders with the aim of ensuring regulated grain trade in the Midwest. After all, at that time there were significant fluctuations in prices for agricultural products, mainly due to seasonal factors and speculative manipulations. To avoid significant price drops in the markets, farmers often had to either withdraw grain from trade or destroy it.

The first way to avoid price distortions was to conclude

forward contracts. Agreements concluded on the exchange provided an opportunity to agree on the price and future delivery before sowing the grain. Soon the Chicago Mercantile Exchange became the main place for the sale of grain. In 1855, France transferred all its deliveries from New York to Chicago, which indicates the efficient operation of the exchange.

The main improvement in the work of the Chicago Mercantile Exchange was the creation in 1858 of a department for the standardization of exchange contracts. This department was engaged in the classification of grain varieties. The quality system provided for several quality checks of the grain during the sale process to ensure the quality and purity of the goods. Often, when storing grain in warehouses of different owners, they were mixed, which affected the subsequent price. In this regard, the Chicago Mercantile Exchange proposed a new sorting and storage system. In particular, farmers received warehouse receipts for the grain they had accepted for storage in exchange warehouses. In addition, the amount of grain was standardized according to the parameters of exchange transactions.

Futures trading on the Chicago Mercantile Exchange helped to transition to trading in large batches of goods, because the delivery itself could not be done, but trading was carried out using warehouse receipts.

Futures contracts guaranteed farmers a certain price in the future months of contract execution.

For

speculation, futures contracts became an excellent tool for making profits from future price changes. Speculation turned

over-the-counter market participants against itself due to speculative sentiment, and on the other hand, it increased confidence in futures trading due to the large number of exchange participants.

In 1888, about 25 billion bushels of wheat were sold through futures contracts without delivering the assets. At that time, only 415 million bushels of wheat were harvested in the United States.

Futures markets at that time facilitated the efficient distribution of grain across states, which ensured price stabilization and the efficient functioning of the spot market for grain crops in the United States.

A comparison of the average annual price fluctuations for the three types of grain crops in percentages (Table 3.1.) shows that wheat and oats, which were traded under futures contracts on the Chicago Mercantile Exchange, had a smaller amplitude of price fluctuations than barley in the period from 1899 to 1916.

It can be seen that price fluctuations on the Chicago Mercantile Exchange were less intense than on the over-the-counter market. After all, only once in 1916 did wheat price fluctuations exceed 100 percent. Meanwhile, oats showed similar statistical variation in 1901 and 1902.

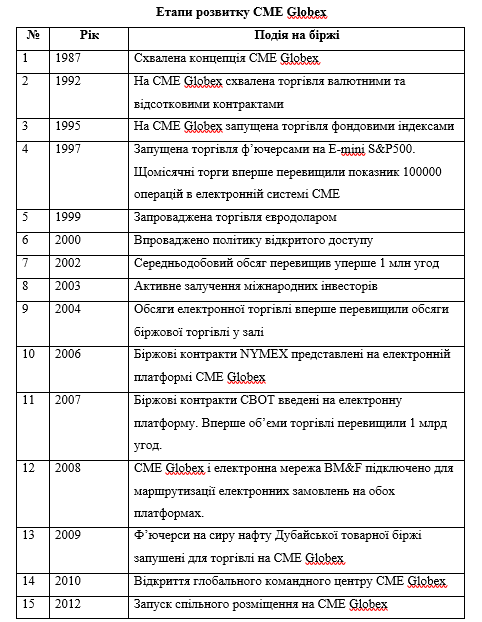

Since the early 1990s, trading in derivative contracts has begun to gain significant

volume on the over-the-counter market and in subsequent years has significantly outpaced stock market performance.

The history of international stock market activity is closely linked in the last century to the American stock market.

In the mid-1990s, new

financial instruments, namely credit default swaps, became the next in trade. Two new acts of Congress, including the Financial Services Modernization Act and the Commodity Futures Modernization Act, contributed to the improvement of exchange regulation in the United States.

Since the new millennium, international stock market trading has recorded an increase in derivatives trading volumes. Thus, in 2017, trading volumes increased to 25 billion, which is almost twice as high as in 2006.

Globalization and the expansion of borders allowed not only to integrate highly developed stock markets into the global

stock exchange system, but also contributed to the spread of international experience in stock trading technologies, new instruments, and new guarantee conditions for stock trading.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу