EUREX is a leading European exchange, which together with Eurex Clearing provides liquid exchange trading and guarantees the execution of exchange contracts at a global level through the electronicization of trading technology.

EUREX is a highly liquid, integrated exchange system that provides innovative solutions for effective price risk management.

The European Exchange EUREX systematically creates innovative derivative contracts and the necessary infrastructure, technologies, offering a wide range of financial products, managing standardized contracts, creating a highly liquid international market with low-cost access for clients and convenient service.

Eurex Exchange is an electronic exchange alliance that offers trading in German and Swiss debt instruments, as well as

stocks and stock indices and other interest-rate contracts.

Eurex Exchange is open to participants in exchange trading, analysts and others wishing to familiarize themselves with the work of the exchange on the

basis of the exchange's information website.

Eurex Exchange is headquartered in Germany, near Frankfurt am Main. Since the 1990s, the London

Stock Exchange LIFFE has been promoting competition in the German government bond market by the German DTB exchange. The latter was perhaps the first fully electronic exchange in the world. At the same time, the German DTB exchange began a merger with the Swiss SOFFEX exchange.

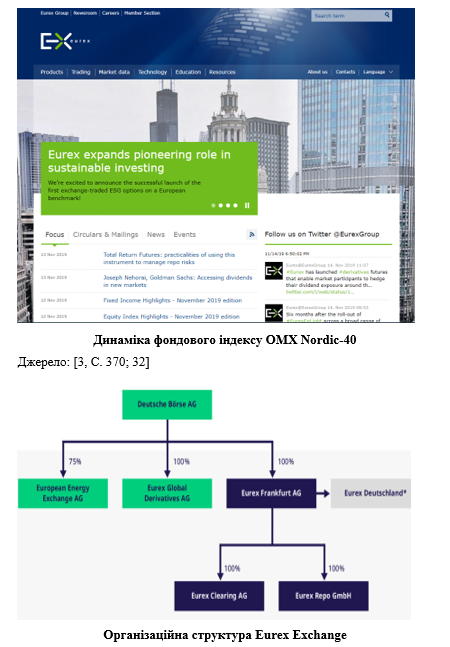

As a result, the Eurex electronic exchange alliance was established in 1998. This was also facilitated by the existing cooperation between several operators of DTB and SOFFEX, as well as Deutsche Börse AG and SIX Swiss Exchange. The cooperation ultimately contributed to the launch of an electronic exchange platform, making a breakthrough in the online trading exchange industry.

The Eurex Exchange can be considered innovative and open to new developments, in particular the introduction of new exchange contracts and new underlying assets, such as cryptocurrencies. Among European exchanges, this exchange is practically the only one that provides trading in futures and options on futures on a real estate index. These are contracts with a term of 1 year, which are calculated on the basis of quarterly indices of the UK MSCI-IPD for individual calendar years.

Thanks to real estate derivative contracts, it is possible to provide the advantages of these contracts in comparison with

over-the-counter types of contracts, which contributed to the attraction of new participants in the markets of real estate derivative contracts, ensuring high liquidity of these markets.

Among other advantages of Eurex Exchange was the ability to provide access to US exchange platforms. This exchange provides access to various types of derivative contracts that are implemented on American exchange platforms through electronic terminals. All of these derivative contracts are exchange-traded instruments licensed by the US Commodity Futures Trading Commission and the

Securities and Exchange Commission.

Since 2015, Eurex Exchange has been involved in cooperation with the US Securities and Exchange Commission in the field of exchange-traded options trading in foreign markets and the regulation of members of this sector in order to participate in activities to familiarize dealers with the activities of the US

stock market.

Eurex Exchange is now a global exchange-traded network for commodity and financial derivative contracts. It unites more than 7,700 exchange traders in more than 35 different countries around the world, implementing more than 6 million contracts on average every day.

The exchange currently provides trading in derivative contracts, as well as the opportunity to buy and sell securities and a wide variety of over-the-counter instruments. Nowadays, many international exchanges are introducing over-the-counter contracts, such as swap contracts, to their platforms.

Exchange trading in commodity derivatives on the Eurex Exchange is growing every year and attracting new investors who want to invest in exchange instruments. Exchange derivative contracts are quite well-known, namely futures and options on futures for gold and petroleum products.

Exchange trading in precious metals, in particular gold, is one of the largest in the world with assets under management of 4 billion Euros. Exchange derivatives on gold allow you to invest in them or use them to manage price risks in dynamics. In addition to gold, the exchange contract for silver is also attractive.

Among other commodity assets, such commodity assets as oil and its by-products are also traded on the European exchange. These instruments are also popular among investors. The European Exchange provides exchange quotes for US light crude oil WTI.

WTI crude oil futures provide an opportunity to develop trading strategies to hedge price risks in the presence of price

volatility in the spot oil markets.

Institutions that wish to carry out professional activities on Eurex Exchange through the existing integrated system can also carry out trading and clearing.

Legal entities can apply for membership on Eurex Exchange. Individuals cannot become members of the exchange. However, when legal entities become members of the exchange, they have the right not to limit the number of registered exchange traders on their behalf on the exchange.

Exchange members can also participate in clearing transactions directly or through other registered clearing members. Eurex Exchange participants who wish to participate in clearing settlements must first apply for a clearing license. Exchange members who do not have a clearing license must work with exchange members who do have such a license.

Exchange members may also act as market makers to improve the efficiency or liquidity of exchange trading.

Шрифти

Розмір шрифта

Колір тексту

Колір тла

Кернінг шрифтів

Видимість картинок

Інтервал між літерами

Висота рядка

Виділити посилання

Вирівнювання тексту

Ширина абзацу